There’s a vital need for you to understand the process of obtaining a crash report after an automobile incident in Towner County, North Dakota. This guide walks you through the necessary steps to ensure you have the necessary documentation for insurance claims and legal matters. Whether you’re involved in a minor fender bender or a serious collision, knowing how to navigate the reporting system can make all the difference in protecting your rights and facilitating a smooth recovery.

Initiating the Crash Report Process

Starting the crash report process involves swift action to ensure all relevant details are captured before they fade from memory. You should begin by ensuring the scene is safe and then gather all necessary information, including the time, place, and circumstances surrounding the incident. Taking photographs of the scene, vehicle damage, and any injury can also be immensely helpful for future reference and to support your claims.

Key Information to Gather Immediately

Collecting critical facts at the accident scene is vital. Make sure to document the names, contact details, and insurance information of all involved individuals, as well as any witnesses. Additionally, write down the make and model of the vehicles involved, their license plate numbers, and take notes about the weather and road conditions, which can shed light on the situation.

Reporting to the Right Authorities

Reporting your accident to the appropriate authorities is crucial for ensuring that everything is documented legally. In Towner County, this means contacting local law enforcement or state police, depending on the nature of the crash. By filing a report with the correct agency, you create an official record that can be invaluable for insurance claims or any legal actions that may arise post-accident.

In Towner County, you can reach out to the North Dakota Highway Patrol or the local sheriff’s office to report the crash. Each agency has specific protocols for processing accident reports, which often require a detailed description of the event, including any contributing factors. This official report will serve as a key piece of evidence should disputes arise between insurance companies or in court proceedings. Keep your report number handy, as it will be crucial for tracking the status of investigations or obtaining copies of the report later on.

Navigating the Paperwork Maze

Paperwork after a crash can feel overwhelming, but breaking it down into manageable steps simplifies the process. Knowing what forms to fill out, where to find them, and whom to talk to at each stage helps create a clearer path forward. This stage is as important as dealing with any physical injuries, ensuring that you secure the compensation or assistance you need.

Understanding Required Documentation

Familiarizing yourself with the required documentation is vital in moving through the paperwork maze effectively. Typically, you’ll need an accident report, medical records, insurance details, and sometimes, witness statements. Obtaining all necessary documents ensures that you present a strong case for any claims or legal proceedings that may arise from the incident.

Strategies for Efficient Submission

Submitting your paperwork efficiently can save you time and potential headaches. Start by creating a checklist of required documents, so you can track what you have and what’s still needed. Use digital tools to fill out forms and gather documents in one place, allowing for quick access. If submissions are online, consider doing everything in one go to avoid multiple visits or follow-ups.

Using a digital checklist can streamline the submission process significantly. For instance, organizing documents into digital folders for easy retrieval reduces the chances of missing vital paperwork. Setting reminders for submission deadlines ensures that nothing slips through the cracks. With a focused approach along with tracking your progress, you can navigate the paperwork maze with more confidence, leading to a smoother resolution of your post-accident obligations.

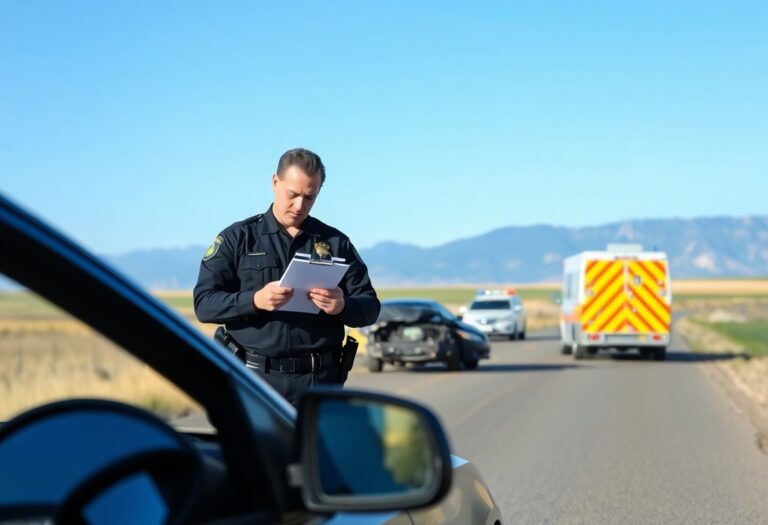

Engaging with Law Enforcement

Engaging with law enforcement is a pivotal part of the crash report process in Towner County. Whether you’re the driver, a passenger, or a witness, effectively communicating with officers ensures that the details of the incident are recorded accurately. Understanding the local procedures and being prepared with specific information can streamline your interactions and help avoid unnecessary delays in filing your reports.

How to Request a Police Report

To request a police report, start by visiting your local law enforcement agency’s website or office. Typically, you’ll need to provide details like the date, time, and location of the crash, along with your contact information. Some agencies allow online requests, while others may require you to complete a form in person. There may also be a small fee associated with obtaining the report.

Communicating Effectively with Officers

Effective communication with officers can significantly impact how your case unfolds. Approach conversations with a calm demeanor and provide them with accurate, concise, and relevant information. Ensuring to provide your driver’s license and insurance details will facilitate the process. Stay focused on the facts, avoiding speculation or emotional responses, which can cloud the discussion.

Approaching officers with respect and clarity sets the tone for productive dialogue. When discussing the incident, clearly state the *who, what, when, and where* to help officers grasp the situation quickly. Listening actively to their questions also aids in providing precise answers. Miscommunication can lead to confusion, so feedback such as summarizing what the officer has stated helps confirm understanding and keeps the lines of communication open. Additionally, if language barriers exist, don’t hesitate to ask for a translator to ensure accurate communication. Investing time in this engagement can enhance the quality of your crash report significantly.

Interpreting Your Crash Report

Deciphering a crash report can provide critical insights into the circumstances surrounding your accident. Understanding the layout and content of the report will help you assess responsibility and damages accurately. Each report typically includes eyewitness statements, police observations, and vehicle damage descriptions, which can be valuable in your insurance claim process or any legal actions you may pursue. Master each section, as every detail matters when reconstructing the events of the accident.

Common Terminology and Sections Explained

Familiarity with common terms and sections within your crash report is vital. Expect to find key components such as incident date, location, involved parties, and witness accounts. Often, you’ll encounter technical language regarding vehicle damage and conditions. Notably, police-coded diagrams may illustrate how the accident occurred, which can significantly impact liability assessments. Knowing what these terms mean will allow you to address your case comprehensively.

Identifying Potential Errors in the Report

Errors in your crash report can lead to significant complications in your case. Look for discrepancies in personal information, vehicle details, or witness statements. Verify that the report aligns with your understanding of the accident, as inaccuracies can affect insurance claims or legal proceedings. If any incorrect information is noted, act swiftly to correct it by contacting law enforcement or an attorney, as timely amendments can make a difference in the outcome.

If a police officer inaccurately recorded your vehicle’s license plate number or omitted critical facts, these errors could misrepresent the events of the crash in the eyes of insurance companies and the legal system. Review your crash report thoroughly, comparing it to any personal notes or photographs you took at the scene. Don’t hesitate to reach out for assistance in rectifying mistakes; doing so can significantly impact how your claim is processed. You want the details to be clear and accurate to establish a strong case, whether for insurance or legal purposes.

Pursuing Claims with Insurance Companies

Once you have your crash report in hand, pursuing your claim with the insurance companies is the next step. Ensure that you submit all the necessary documents, including your crash report, medical reports, and repair bills, to support your case. Engage with your insurance provider promptly, as delays can hinder your recovery process. Their evaluation of your claim will significantly influence your compensation, so anticipate the various outcomes and prepare accordingly.

Filing Your Claim: Necessary Steps

Filing a claim requires a structured approach to avoid complications. Start by notifying your insurance company as soon as possible after the accident. Provide them with all crucial information, including your policy details and the crash report. Collect documentation, including photos of the damage, witness statements, and medical records. Ensure you keep a record of all communications with your insurer to facilitate a smoother claims process.

Tips for Negotiating with Insurers

Negotiation is key when dealing with insurance companies, as they may initially offer settlements that do not reflect the true costs of your damages. Be prepared to present comprehensive documentation to justify your claim and always advocate for your interests. Stay calm and collected during discussions, and avoid accepting the first offer, as many insurers start with lower amounts anticipating negotiations.

- Documentation is crucial; gather everything related to your accident.

- Research similar claims to understand average settlement amounts in Towner County.

- Be assertive in discussions, indicating you’re aware of your rights.

- Communicate clearly about your needs and expectations, ensuring they understand your position.

- After reviewing your options and doing your homework, you can successfully negotiate a higher settlement.

Negotiating with insurers demands your attention and assertiveness. Start by clearly articulating your claim, presenting documented evidence of your losses, and outlining specific compensation requests. Don’t hesitate to use comparable case settlements to strengthen your argument. Keep your tone professional but firm, emphasizing that you won’t settle for less than you deserve. After laying out your case, be prepared for counter-offers and maintain flexibility, while still advocating for the compensation that reflects your realities.

- Be sure to document all communications with the insurance company for reference.

- Utilize case studies or comparable incidents to solidify your position.

- Stay organized and keep deadlines in mind as you follow up on your claim.

- Consider consulting with a legal professional to navigate complex situations.

- After investing your time and energy into negotiations, seek a fair resolution that compensates for your losses.

Final Words

Considering all points, understanding the step-by-step process for obtaining a crash report in Towner County, North Dakota, empowers you to navigate through potential challenges effectively. By knowing the necessary procedures, required documents, and fees involved, you can ensure that you obtain the information you need without unnecessary delays. Your preparation and diligence will ultimately contribute to a smoother experience in managing any aftermath of a vehicle crash.