Many residents in Rankin County experience the aftermath of car accidents, making it vital for you to understand how to obtain car accident reports efficiently. In this blog post, you will discover the streamlined process that ensures you receive your accident records without unnecessary complications. We’ll guide you through the legal nuances, vital documentation, and provide useful tips to navigate the system effectively. This information aims to empower you, making your path to accessing vital reports straightforward and hassle-free.

The Complex Landscape of Car Accident Reporting in Rankin County

Navigating the intricacies of car accident reporting in Rankin County can be daunting. The local laws and regulations dictate a specific process for documenting incidents, which varies based on the severity of the accident and the parties involved. Understanding these guidelines not only helps you comply with your legal responsibilities but also ensures that you have the proper documentation in case of disputes or insurance claims.

Legal Obligations for Accident Reporting

In Rankin County, you are legally required to report a car accident if there are injuries or fatalities, or if property damage exceeds $500. Failure to report can lead to penalties, including fines. You must provide accurate details, including the time, place, and nature of the incident, which will serve as a formal record for law enforcement and insurance purposes.

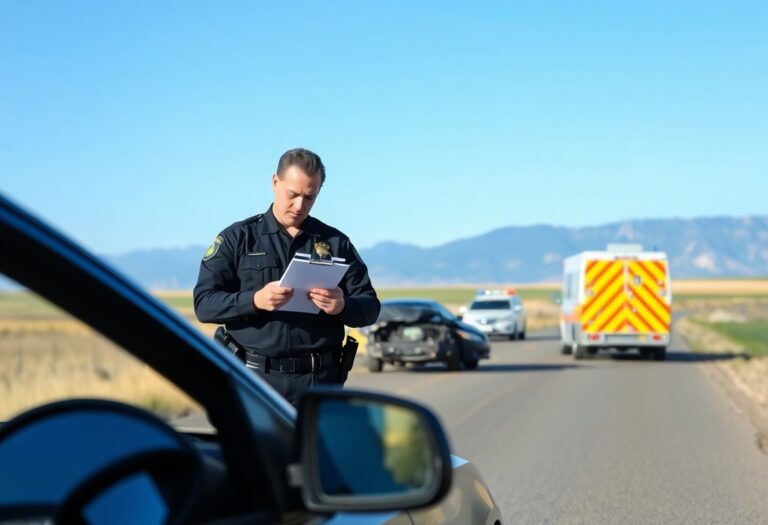

Role of Law Enforcement in Accident Reports

Law enforcement plays a pivotal role in car accident reporting within Rankin County. Officers are usually dispatched to the scene to assess the situation, collect evidence, and interview witnesses. Following their investigation, they compile an official accident report, which includes critical details that can significantly impact insurance claims and any potential legal proceedings.

This official accident report is vital for your case. Officers document necessary information, such as the parties involved, vehicle details, witness accounts, and any citations issued. Their impartial assessment can sway insurance claims in your favor and provide a foundational legal document if disputes arise. In Rankin County, having this report is often a key component in securing compensation for damages and injuries sustained during an accident.

Navigating the Paperwork: Essential Documents and Their Importance

Completing the necessary paperwork following a car accident can significantly impact the outcome of your claim. Each document tells a part of the story, providing valuable evidence for both insurance companies and law enforcement. Understanding which documents are required simplifies the process and ensures you’re adequately prepared for any ensuing investigations or claims.

Key Information Required for Reports

To accurately file a car accident report, you’ll need to gather key information such as your driver’s license number, insurance details, vehicle registration, and the contact information of all parties involved. Including witness statements and photographs of the accident scene can further strengthen your report, providing context for the events that took place.

Understanding the Differences Between Insurance and Police Reports

Insurance reports and police reports serve distinct purposes in the aftermath of a car accident. Police reports document the details of the incident, including witness accounts and officer observations, and are often considered an official record of the events. Meanwhile, insurance reports are submitted to your insurance company, outlining the incident for coverage decisions. These documents work together but present unique data to different audiences.

The distinction lies in the focus and authority of each report. Police reports, generated by law enforcement, often carry more weight in legal contexts and may include conclusions regarding fault. In contrast, insurance reports are personal and based on your perspective and claims, which are then evaluated by insurance adjusters. Having both at your disposal can bolster your case, enabling you to provide a comprehensive view of the incident that supports your claims for damages or injuries.

Leveraging Local Resources: Where to Find Help

Accessing local support can ease the process of handling the aftermath of an accident. Rankin County boasts a variety of resources tailored to assist you in navigating your situation with greater confidence and clarity. Whether seeking emotional support or practical assistance, knowing where to find help can make your journey smoother. Community programs, legal aid offices, and health services are all within reach.

Community Services and Support Centers

In Rankin County, community services and support centers play a vital role in providing assistance post-accident. Organizations such as the Rankin County Recovery Center and the Mississippi Department of Mental Health offer counseling and support groups to aid in emotional healing. These resources can help you process your experience and connect with others who understand your challenges, ultimately fostering a sense of community.

Connecting with Local Legal Assistance

Finding local legal representation can be instrumental in navigating the complexities of accident claims. Rankin County features numerous law firms specializing in personal injury cases, making it easier for you to find qualified help. They can guide you through the legal processes, ensuring that you secure the compensation you deserve from insurance companies effectively.

Local legal assistance in Rankin County often comes with the added benefit of familiarity with the area’s regulations and procedures. Many firms provide free consultations, allowing you to discuss your case without any financial obligation. In addition, local attorneys may have established relationships with insurance adjusters and familiarity with common practices in the state, which can bolster your position when negotiating settlements or pursuing claims. This connection to the community can streamline the process and improve outcomes for accident victims like you.

Common Pitfalls When Filing a Car Accident Report

Filing a car accident report often involves navigating through a minefield of potential missteps. Overlooking crucial details, failing to meet deadlines, and neglecting to obtain necessary documentation can all lead to complications in your case. You must stay organized and informed to avoid these pitfalls and ensure a smooth claims process.

Missteps That Could Delay Your Claim

Many individuals inadvertently make mistakes that extend the timeline of their claims. Failing to report the accident to your insurance company promptly or not collecting witness statements can stall the investigation process. These delays might lead to challenges in receiving your due compensation or even impact the outcome of your claim.

The Importance of Accuracy and Honesty

The integrity of your accident report directly influences the success of your claim. Any discrepancies or dishonesty can not only void your claim but also result in legal consequences. Presenting a clear and truthful account of the incident is vital for ensuring that all parties involved can assess the situation appropriately.

Accurate information helps insurance adjusters evaluate your claim fairly. Providing wrong or misleading details can raise red flags, prompting deeper investigations and potentially halting the approval process. Your description of the accident, the parties involved, and the circumstances surrounding the incident should be detailed and truthful. Collecting evidence, such as photographs and police reports, to corroborate your account strengthens your claim and enhances its reliability. Adhering to these principles fosters trust and expedites the resolution of your case.

Recovery and Compensation: What to Expect After Filing

After filing your car accident claim, you can expect a process that unfolds over a series of stages. Initially, your focus will be on gathering documentation and ensuring that all necessary information is submitted to your insurance company. You may experience a waiting period while the insurer reviews your claim, assesses liability, and determines the extent of your damages. During this time, it’s important to stay organized and follow up on any required communications to keep your claim moving forward.

Insurance Processes and Timelines

The insurance process can vary significantly depending on the complexity of the case and the responsiveness of all parties involved. Typically, insurers aim to respond to your initial claim within 14 to 30 days, but further investigation may extend the timeline. Additional documentation or negotiations can stretch this into several months, particularly if liability is contested.

Potential Outcomes and Next Steps

Outcomes of your claim can range from a settlement offer from the insurance company to litigation if negotiations fail. If you receive a settlement, you will need to assess whether it adequately covers your medical expenses, vehicle damage, and lost wages. Should the offer be insufficient, pursuing legal action might be the next course of action, which usually entails hiring an attorney to represent your interests.

In considering your options, weigh the settlement offer against the potential costs and time involved in litigation. Your attorney can provide insights into the likelihood of a favorable verdict should you take your case to court. On average, settlements can take several months to finalize, while court cases can take a year or more. Evaluating your situation carefully and discussing it with legal counsel will help you make informed decisions on how to proceed and what steps to take next in your recovery journey.

Final Words

Hence, when you find yourself in need of car accident report assistance in Rankin County, Mississippi, you can rest easy knowing that the process can be straightforward and efficient. By understanding how to access reports, seek legal advice, and navigate local resources, you’re empowered to handle your situation with confidence. Whether you’re dealing with insurance claims or legal proceedings, having the right information at your fingertips will make all the difference in resolving your case effectively.