Many individuals find themselves in need of a crash report after an accident, whether for insurance claims or legal purposes. In St. Louis County, obtaining this report is a straightforward process that you can navigate with ease. Knowing how to access your report quickly can save you time and reduce stress during a challenging situation. This guide will provide you with the crucial information you need to obtain your crash report effectively and efficiently.

Navigating the Maze: How to Request Your Crash Report

Requesting your crash report in St. Louis County can seem daunting, but it’s manageable once you understand the process. You have several avenues available including online requests, in-person visits, or phone inquiries. Each method has its own advantages, and choosing the best option depends on your unique situation and urgency.

Online Request Procedures

Utilizing the online portal is one of the most convenient ways to obtain your crash report. You can access the St. Louis County Police Department’s official website, navigate to the crash report section, and follow the prompts to submit your request. Make sure you have relevant details on hand, such as the report number, date of the accident, and your identification information.

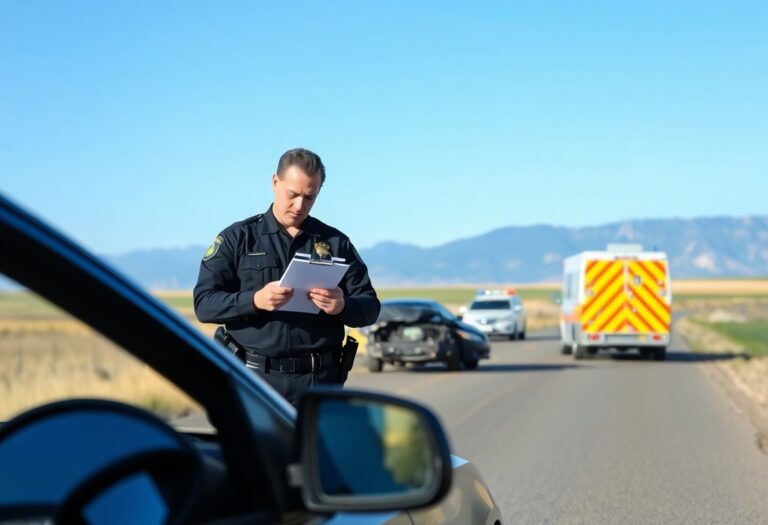

In-Person and Phone Options

For those who prefer direct interaction, visiting your local police station or making a phone call can be effective methods for requesting your crash report. You can present your details in person, ensuring you receive immediate assistance, or you can call and have your questions answered by a knowledgeable officer.

Visiting in person not only allows you to interact with staff face-to-face, but it also provides an opportunity to clear up any misunderstandings or get immediate feedback on your request. Staff can help with specific questions about the report, guide you through necessary forms, and ensure that you have the correct documentation to avoid delays. Alternatively, calling the department may be quicker if you have specific queries or want to confirm available report statuses without making the trip.

Cost Breakdown: What You Need to Know

Understanding the costs associated with obtaining a crash report in St. Louis County is important. Standard fees typically range from $5 to $15, depending on the jurisdiction and document type. Be prepared for potential additional charges if you need expedited service or specific formats for your report. Ensure your budget accounts for these costs to avoid surprises later on.

Standard Fees and Payment Methods

Most agencies charge a standard fee for crash reports, often set at $5 for basic requests and up to $15 for more comprehensive or certified reports. Payment methods can vary, with many offices accepting cash, checks, or credit cards. Always confirm acceptable forms of payment before your visit or submission.

Extra Costs and Considerations

In addition to standard fees, you might encounter extra costs based on the nature of your request. If you need an expedited process for an urgent situation, some agencies may charge a premium for faster delivery. There could also be costs associated with obtaining additional copies, particularly if you require more than one official document.

Other considerations might include the specific details in the crash report you request. For instance, if you need an incident report including additional evidence like photographs or witness statements, there may be extra charges for those. Additionally, some organizations uphold varying rates based on whether you’re a private citizen or institutional requester, so it’s wise to check the specific policies of the agency handling your request.

The Timelines That Matter: How Long to Expect

Understanding the timing of crash report availability can help you plan effectively. Typically, following a crash, you can expect to receive your report within a few days to a few weeks, depending on various factors involved in the processing. If you need the report for legal reasons or insurance claims, getting accurate timelines is imperative to avoid delays in your claims process.

Typical Processing Times

Generally, crash reports in St. Louis County are processed between 5 to 10 business days after the incident. However, if the accident involved more extensive investigations or additional parties, processing may take longer. Ensuring that you have all your necessary documentation can help expedite this process.

Factors That Can Delay Receipt

Several factors can extend the timeline for receiving your crash report, including pending investigations, and the time it takes to gather all driver and witness statements. If there are numerous vehicles involved or if the report requires amendments, your wait time could extend beyond the typical processing times. The complexity of your crash incident can significantly impact how quickly you can obtain your report.

- Pending investigations

- Gathering witness statements

- Amendments required

- Number of vehicles involved

- Police department workload

Consideration of these factors is key. For example, if your accident involved multiple parties or severe injuries, the police may take extended time to finalize the report. You can also contact the police department directly for updates, but they may advise that you wait for processing to be complete before receiving detailed information. The importance of your report in settling insurance claims or any legal matters cannot be understated.

- Multiple parties involved

- Severity of the incident

- Police department capacity

- Documentation completion

- Transition to digital systems

Ensuring Accuracy: Verifying Your Report

Double-checking the information on your crash report is an important step that can save you from potential legal and insurance complications. In St. Louis County, incorrect details can lead to delays in claims processing or even disputes regarding liability. Take the time to carefully review all elements of the report, including the names of involved parties, dates, times, and locations, ensuring everything aligns with your records and recollections of the incident.

Common Errors to Look For

Pay attention to frequent mistakes such as misspellings of names, incorrect vehicle information, or inaccuracies in accident locations. Even minor discrepancies can complicate matters. You might also find errors in the reported circumstances of the accident, which could misrepresent what happened. These inaccuracies can impact liability determinations and your insurance claims.

Steps to Correct Mistakes

To address mistakes in your crash report, you should gather any relevant documents, including photographs, witness statements, or any additional evidence supporting your case. Contact the appropriate law enforcement agency or the department that processed your report, and provide them with the corrected information. Ensure you follow up periodically to confirm that the necessary amendments have been made.

Filing a correction may involve filling out specific forms or submitting a formal request, depending on the agency’s policies. It’s advisable to act promptly; many jurisdictions have deadlines for submitting corrections. Keep a copy of any correspondence for your records and follow up until you receive confirmation that changes have been made. Engaging with the right authorities is key to safeguarding your interests and ensuring your crash report accurately reflects the incident.

Beyond the Report: Legal and Insurance Implications

The details captured in your crash report extend beyond mere documentation; they are foundational to your legal standing and any insurance claims you may submit. In the case of an accident, the report acts as an official summary of the incident, outlining key aspects such as fault, damages, and any citations issued. This information becomes vital when negotiating with insurance companies or in potential court proceedings, influencing both the outcome of your claims and any legal repercussions you may face.

How Your Crash Report Affects Claims

Your crash report significantly shapes the claims process with your insurance provider. Insurers rely on the specifics recorded in the crash report to determine liability and assess the damages. For instance, if the report clearly indicates that another driver was at fault, you may find it easier to secure the compensation you deserve. Conversely, conflicting information or an unfavorable report can lead to claim denials or lengthy negotiations.

Understanding the Legal Context

Legal implications stemming from a crash report can be far-reaching, impacting everything from settlement negotiations to courtroom outcomes. The report serves as a formal record of the accident and influences both civil and criminal matters. For example, if your crash resulted in injuries or significant property damage, the findings in the report may be scrutinized during legal proceedings, including liability assessments and insurance payout calculations. It’s not just about the accident itself, but how the incident is interpreted legally, which can significantly affect your financial liability and future responsibilities.

Defending or challenging claims often hinges on the crash report’s content. If discrepancies arise, such as differing accounts of how the accident occurred, the report can be pivotal in establishing a clear narrative. For example, in a case where a driver claims they had the right of way, but the report indicates otherwise, the latter’s detail may settle disputes more quickly. Additionally, the documentation can serve as a key piece of evidence should you need to appeal any decisions or present your case in court. Knowing how to navigate this legal landscape is important for effectively protecting your interests.

To wrap up

On the whole, if you need a crash report in St. Louis County, Missouri, you can rely on our services to assist you. We simplify the process, ensuring you obtain the necessary documentation efficiently and accurately. Whether for insurance claims, legal matters, or personal records, we are here to provide the guidance you need. Don’t hesitate to reach out for our expert help in securing your crash report with ease.