With the unpredictability of car accidents, navigating the aftermath can be overwhelming. In Pocahontas County, Iowa, you can depend on our streamlined process to help you efficiently manage your car accident report. Our goal is to simplify your experience, allowing you to focus on recovery while we guide you through the necessary steps. Accessing vital information and resources will empower you in this challenging time, ensuring you know what to do next and how to protect your rights.

Navigating the Legal Landscape of Car Accidents in Pocahontas County

Understanding the legal implications following a car accident in Pocahontas County is vital for protecting your rights and ensuring proper compensation. Various laws govern liability, insurance claims, and accident documentation. Knowing how to navigate this legal landscape can simplify the process and reduce the stress associated with potential legal battles.

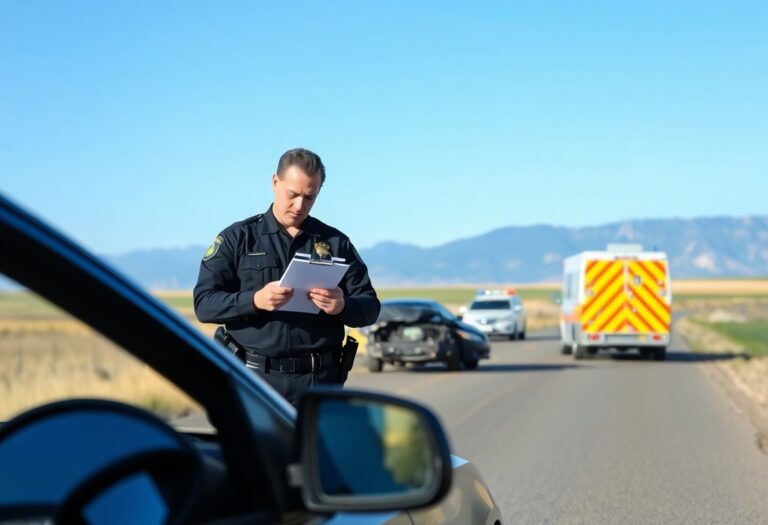

The Role of Law Enforcement in Accident Reports

Law enforcement plays a key role in documenting accidents, which can have lasting effects on your case. Officers will assess the scene, collect evidence, and create an official accident report detailing the circumstances. This report serves as an vital piece of documentation that insurance companies and legal representatives rely on to establish liability and assess damages.

Understanding Your Rights and Responsibilities Post-Accident

After a car accident, you have specific rights and responsibilities that can significantly impact your situation. You are entitled to receive proper medical care and compensation for damages, but it is equally important to report the accident to your insurance company promptly. Failure to report may jeopardize your ability to receive compensation. Additionally, you may have the right to seek legal advice, especially if you feel that your rights are not being respected.

Post-accident, knowing what you can and must do is pivotal. For instance, if injured, seeking medical attention immediately not only safeguards your health but establishes a medical record for any claims you may file. Reporting the accident to your insurance within the specified timeframe is vital as many policies have strict rules on notification. Furthermore, if you encounter issues dealing with insurance companies or unfair treatment, understanding your right to consult with an attorney can help you receive the fair compensation you deserve.

Streamlining the Documentation Process

Efficiently managing the documentation of a car accident can significantly reduce stress during an already difficult time. You can save valuable time and avoid frustrations by methodically organizing all relevant information. Utilizing templates for accident reports and checklists for necessary documentation ensures that no vital details are overlooked. This streamlined approach not only helps you keep track of your records but also aids in speeding up the claims process with your insurance company, making for a smoother recovery.

Essential Information to Collect at the Scene

Gathering imperative information right at the scene is key to a successful report. You should document the names, contact details, and insurance information of all involved parties, alongside taking photographs of the accident scene and vehicle damage. Additionally, jot down the date, time, and location of the accident, along with any witness statements. This detailed record helps create a clear picture of what happened and supports your claim later on.

How to Obtain and Interpret Official Accident Reports

Acquiring and understanding official accident reports is vital in addressing the aftermath of a car accident. You can usually obtain these reports through your local law enforcement agency or department of motor vehicles. Understanding the report requires reviewing facts such as circumstances of the accident, involved parties’ statements, and law enforcement observations. This information can be pivotal in supporting your case, whether it’s for insurance claims or potential legal actions.

To obtain an official accident report, you typically need to submit a request to the relevant police department, often accompanied by a small fee. Most agencies provide access to these reports online or in person. Once you receive the report, analyze it by focusing on details like diagrams and statements, as they influence how liability is assessed. Discrepancies in the report can be addressed through further evidence, reinforcing your position and ensuring that your narrative is supported by official documentation.

The Impact of Insurance Claims on Accident Reporting

Your insurance claim significantly influences the accident reporting process. Insurance companies often require detailed reports to assess liability and damages. A comprehensive accident report, including statements, photographs, and witness information, can facilitate a smoother claim process. Moreover, effective communication with your insurer helps ensure that all relevant facts are conveyed, aiding in expedient claim resolution. Understanding how these elements interact can empower you to manage your situation effectively.

Collaborating with Your Insurance Provider Effectively

Common Pitfalls in the Claims Process and How to Avoid Them

The Importance of Timeliness in Reporting Accidents

Reporting a car accident promptly ensures accurate documentation and facilitates a smoother claims process. Insurance companies often require timely reports to prevent disputes regarding liability or compensation. Given that evidence such as witness testimonies and physical damage can deteriorate over time, acting quickly can influence the outcome of your claim significantly.

Consequences of Delayed Reporting

Delays in reporting can lead to serious financial repercussions and complications in your claims process. Being late can result in denied claims or reduced settlements, causing additional stress and complications when you need to recover from an accident. Furthermore, law enforcement may have limited information to work with, making it harder to establish fault.

Best Practices for Prompt Report Submission

Submitting your accident report swiftly involves a few straightforward steps. First, gather all necessary details at the accident scene, including photographs, contact information for witnesses, and insurance details from the other parties involved. Submit the report to your insurance company and the local authorities within the designated time frame, which usually ranges from 24 to 72 hours, depending on your insurance policy.

Establishing a habit of quick reporting can make a significant difference in the aftermath of an accident. Consider creating a checklist to facilitate gathering all required information, including any photos and witness contacts. Additionally, familiarize yourself with your insurance policy’s reporting requirements to avoid missing any crucial deadlines. Having a plan in place not only alleviates stress but also ensures you’re well-equipped to handle the accident’s ramifications efficiently.

Leverage Technology for a Smooth Reporting Experience

Utilizing modern technology can significantly enhance your car accident report experience. Accessing streamlined digital solutions helps you capture crucial information quickly, ensuring nothing is overlooked. With numerous tools available, you can effectively navigate the post-accident process, empowering you to focus on recovery instead of paperwork.

Mobile Apps and Digital Solutions for Real-Time Reporting

Many mobile apps provide instant reporting features that allow you to document incidents immediately after an accident. These applications often include templates for recording details such as time, location, and other involved parties. Utilizing these tools increases the accuracy of your information and decreases the time spent on tedious paperwork.

Utilizing Online Resources to Simplify Your Process

Online resources streamline your car accident reporting, ensuring you have access to necessary forms and information without unnecessary hassle. Websites often host templates for accident reports, claim forms, and even guidance on local laws and insurance requirements in Pocahontas County. By using these digital platforms, you gain easy access to everything you need for a seamless reporting process.

Leveraging online resources further minimizes stress by offering comprehensive guides tailored to your locality. Websites like state transportation departments provide detailed instructions, and local insurance agencies may supply relevant claim forms and requirements. Moreover, forums and communities can connect you with others who have navigated similar experiences, granting you valuable insights and support. Using these accessible resources, you can approach your reporting obligations with confidence and efficiency.

Final Words

Presently, navigating the car accident report process in Pocahontas County, Iowa, is simplified for you. Our resources and expert guidance ensure that you can efficiently manage the paperwork and understand your rights following an accident. By staying informed and utilizing available support, you can confidently handle your situation and protect your interests. Your peace of mind is our priority as you move forward after this challenging experience.