There’s a lot to navigate after a car accident, and knowing how to obtain your car accident report in Lafayette County, Missouri can significantly ease the process. This guide will walk you through the steps needed to access your report, ensuring that you have the necessary documentation for insurance claims or legal matters. Timeliness is key, as reports can impact your next steps. You’ll find practical tips and important details to help you successfully manage this important process and keep your stress levels low.

The Legal Framework: Missouri’s Car Accident Reporting Requirements

In Missouri, the law mandates that certain conditions trigger the obligation to file a car accident report. Understanding these requirements can mitigate legal issues and protect your rights following an accident. You are required to report an accident if there are injuries, fatalities, or property damage exceeding $500. Additionally, filing a report is vital if you plan to pursue a claim with your insurance company. Failing to file as required could result in penalties, including fines and complications with potential compensation.

Who Needs to File an Accident Report?

Any driver involved in a car accident in Missouri must file an accident report if it meets specific criteria. If you are at fault and your accident results in injuries, fatalities, or damages exceeding the set monetary threshold, you are obligated to report it. Both parties involved should ideally report the incident to ensure all relevant details are on record.

Time Limits for Reporting Accidents

Filing a car accident report in Missouri has a strict timeline. You must submit the report to the Department of Revenue within 30 days of the accident. If you neglect to file within this time frame, you put yourself at risk of fines and complications with insurance claims.

Being aware of the 30-day reporting limit is vital for protecting your interests. Ensure that all details are accurately documented on the report to avoid delays or disputes with insurance companies. It’s also advisable to gather and maintain all evidence, including photos and witness statements, during this period to strengthen your report and any subsequent claims. Filing promptly can provide clarity and assist in seamless communication with legal and insurance representatives.

Gathering Essential Information at the Scene

Upon arriving at the scene of the accident, promptly gather key details that will aid in filing your report. Collect the names, contact information, and insurance details of all involved parties. Take note of vehicle makes, models, license plate numbers, and the specific location of the accident. Ensure you document the time and conditions, such as weather and visibility, as these can be significant in assessing liability and reconstructing the incident.

Key Details to Collect from Involved Parties

From each person involved in the accident, gather vital information including full names, phone numbers, addresses, insurance company details, and policy numbers. Additionally, jot down the driver’s license numbers and license plates. This foundational information will not only expedite the claims process but also be vital in establishing the facts of the case later on.

Importance of Witness Statements and Photographic Evidence

Witness statements can provide an objective perspective on the accident, while photographic evidence serves as a visual record of the scene. Engage any witnesses immediately; ask them to share what they observed. Take photos of all vehicles involved, the surrounding area, and any damage. These elements can support your account and significantly strengthen your case when dealing with insurance companies and legal matters.

Obtaining witness statements and photographic evidence can make a marked difference in the outcome of your case. A neutral bystander may recall details that everyone else overlooks, such as the actions of each driver leading up to the accident. High-quality photos capturing the scene, damage, and road conditions can clarify ambiguous situations. Their combined contributions serve as powerful tools to support your narrative, enhancing the credibility of your report and increasing the likelihood of a favorable resolution.

Navigating the Reporting Process: Step-by-Step

| Step | Description |

|---|---|

| 1 | Ensure safety and document the scene. |

| 2 | Gather information from all parties involved. |

| 3 | Complete the required forms. |

| 4 | Submit reports to the appropriate authorities. |

Completing the Required Forms

To initiate the reporting process, you will need to fill out several required forms. These documents often include an accident report form, which captures important details like time, date, location, and parties involved. Each driver’s insurance information should be included, as well as descriptions of damages and injuries. Accuracy is vital; any discrepancies can affect insurance claims and legal proceedings.

Submitting Reports to the Appropriate Authorities

Once your forms are completed, submit them to law enforcement and your insurance provider as soon as possible. For matters involving injury or extensive damage, submit the report to the local police department or sheriff’s office in Lafayette County. Your insurance company should receive a copy of the report for their records, which can expedite the claims process.

After submitting your reports, keep copies for yourself. Maintaining documentation can be beneficial if disputes arise regarding liability or damages. Follow up with the police department to confirm that they have processed your report. This follow-up ensures that you are aware of any further steps needed and helps you stay informed about the status of investigations, which can be critical for any claims related to the accident.

Understanding the Impact of Accident Reports on Insurance Claims

The information detailed in car accident reports can significantly shape your experience with insurance claims. Insurers rely heavily on these documents to assess liability, determine compensation amounts, and guide their investigation processes. A well-documented report increases the likelihood of a fair resolution, while inconsistencies or inaccuracies might jeopardize your claim. Accurate information can help establish a clear narrative of the events, affirming your position and supporting financial restitution.

How Reports Influence Claim Outcomes

Accident reports serve as primary evidence in insurance claims, especially when determining fault. Insurers analyze these reports to decipher the series of events leading to the accident, which can directly affect the compensation you receive. For instance, if the report indicates flagrant violations of traffic laws by another party, it strengthens your claim for damages, potentially leading to a more favorable outcome.

Common Pitfalls to Avoid in Reporting

Reporting an accident can be straightforward, but there are several pitfalls that can undermine your claim. Failing to document important details, such as eyewitness accounts or pictures of the scene, can hinder your case. Additionally, avoid making speculative comments about fault or liability, as these can be misconstrued later. Always stick to the facts and ensure you have a copy of the report for your records.

Your car accident report must be accurate and devoid of personal assumptions to ensure the claim process flows smoothly. Providing unclear or ambiguous information can lead to misinterpretations by the insurance company, which can ultimately result in lower settlements or denied claims. For instance, if you suggest that you might have contributed to the accident when evidence suggests otherwise, this can confuse the adjudication process. Filling out the report with clarity and confidence about the events can avoid these tricky situations and keep your chances of a successful claim intact.

Querying and Accessing Accident Reports Post-Filing

After filing your car accident report, acquiring a copy for your records or insurance purposes is straightforward. Begin by contacting the relevant law enforcement agency that documented the accident. They will provide guidance on any specific requirements, such as submitting a formal request or providing your case number, to access your report. Most agencies maintain an efficient system for this process, ensuring you receive your report promptly.

How to Obtain a Copy of the Report

To obtain a copy of your car accident report, reach out to the appropriate law enforcement office—such as the local police department or sheriff’s office. You may need to fill out a request form either online or in person, depending on the agency’s procedures. Providing necessary details like your name, the date of the accident, and any involved parties will streamline the process.

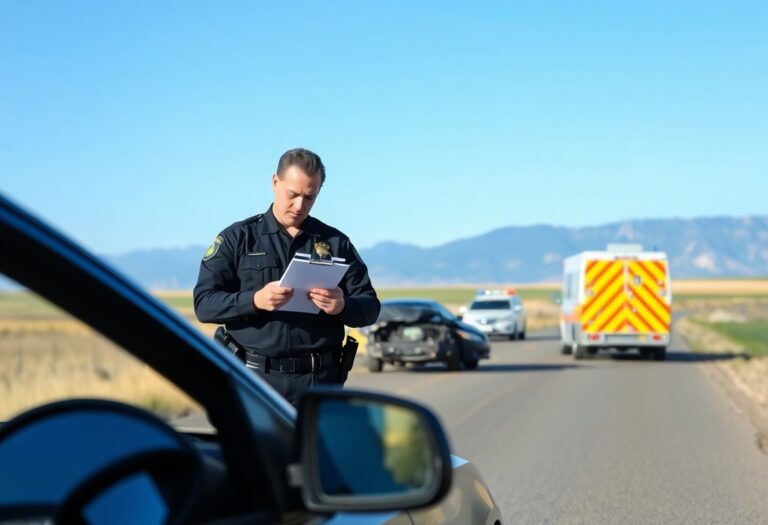

The Role of Law Enforcement in Report Verification

Law enforcement officers play a critical role in the accident report verification process. Their responsibility includes collecting eyewitness accounts, documenting the scene, and assessing damages. This information is woven into the official report, ensuring it accurately reflects the incident’s circumstances, thereby enhancing the report’s reliability for all parties involved, including insurance companies and attorneys.

Verification by law enforcement helps maintain the report’s integrity. For instance, the officer’s observations and conclusions regarding fault or negligence provide an objective third-party perspective that can be necessary in resolving disputes. If discrepancies arise, insurance adjusters or attorneys often refer back to these documented accounts to establish facts, making law enforcement involvement a pivotal component in validating your case.

Summing up

To wrap up, navigating the process of obtaining your car accident report in Lafayette County, Missouri is straightforward when you know the steps. By following the outlined procedures, you can ensure that you obtain the necessary documentation for insurance claims and legal matters. Always keep your personal information organized and be prepared for any fees or identification requirements when making your request. With this guide, you can approach the process with confidence and ease.