Navigating the Crash Report Landscape in Madison County

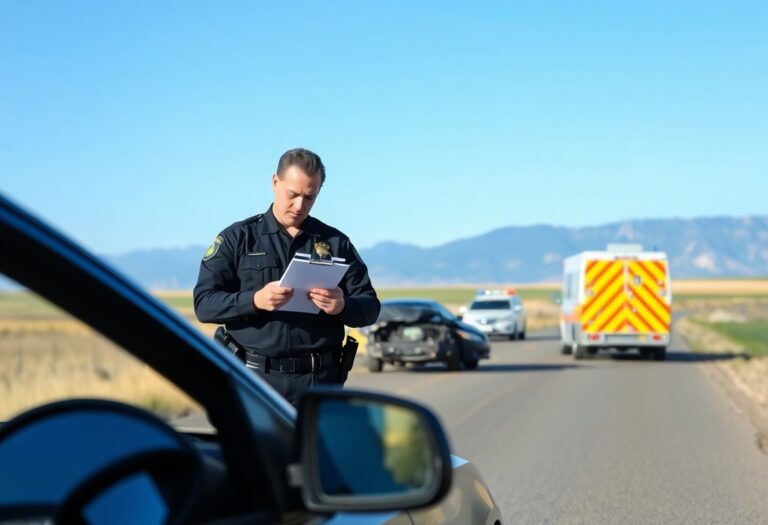

Understanding the crash report process in Madison County requires familiarity with both the legal framework and local law enforcement practices. Upon the occurrence of an accident, you’ll need to ensure that a report is filed with the local police department, usually within 24 hours of the incident. You can retrieve your report online through the Virginia Department of Motor Vehicles (DMV) website or directly from the Madison County Sheriff’s Office. Reports are typically available within 5 to 7 business days and may include critical information such as accident location, involved parties, and witness statements. Accessing this information is imperative for insurance claims and potential legal action.

Essential Legal Framework for Accident Documentation

Understanding the legal requirements surrounding accident documentation in Virginia equips you with the knowledge necessary to navigate potential liabilities and insurance claims effectively. Laws dictate not only what information you should collect at the scene but also outline the deadlines for submitting reports and the types of accidents that must be documented. Having a clear grasp of these regulations will provide you a solid foundation in safeguarding your legal rights following a car crash.

Overview of Virginia’s Accident Reporting Laws

Virginia law mandates that any accident resulting in injury, death, or property damage exceeding $1,500 must be reported to the local police and the Department of Motor Vehicles (DMV). The law stipulates that you must file an accident report within ten days of the incident, ensuring that all involved parties’ information and any pertinent details are documented correctly for future reference.

Understanding the Importance of Timely Reports

Submitting accident reports promptly is crucial for ensuring your legal and financial protection in the aftermath of a collision. Timeliness not only preserves critical evidence but also aids in expediting your insurance claims process. Delaying your report can result in complications, including disputes over liability or the coverage of damages, which may ultimately hinder receiving compensation for your losses.

Filing your accident report promptly can significantly impact the outcome of your case. For instance, insurance companies generally prioritize timely claims and investigations, with evidence being freshest immediately after the incident. Delaying the report might lead to missing out on vital witness statements or physical evidence that can support your claims. Per Virginia law, waiting too long can also risk the possibility of fines or penalties, especially if you fail to meet the ten-day submission requirement. By staying proactive, you ensure that your rights are protected and are better prepared for any legal action stemming from the accident.

Step-by-Step Process for Obtaining Crash Reports

Obtaining a crash report in Madison County, Virginia, is a straightforward process that involves specific steps to ensure you receive the correct information. Start by gathering necessary details about the accident, such as the date, location, and involved parties. Then, follow these concise steps outlined in the table below:

| Step | Description |

|---|---|

| 1 | Visit the appropriate law enforcement agency’s website. |

| 2 | Fill out the request form for crash reports. |

| 3 | Provide necessary details: date, location, and parties involved. |

| 4 | Submit the request form along with any required fees. |

| 5 | Receive your report by mail or electronically based on the submitted preference. |

How to Request a Copy of Your Report

Your first step to request a copy of your accident report is to identify the correct agency. Visit their official website where you can find the specific request protocol. You will typically need to complete a form and possibly pay a small fee. Once submitted, your report will usually be processed and sent to you within a few days, ensuring you have access to your documentation quickly.

Understanding Different Report Types: Police vs. Insurance

There are significant distinctions between police reports and insurance reports. A police report provides an official account of the incident, including statements from those involved, legal outcomes, and a summation from the responding officer. In contrast, an insurance report focuses on details necessary for claims processing and may not include all accident particulars as seen in the police report. Understanding these differences aids you in determining which document is more applicable to your situation.

- Police report offers an official narrative of the accident.

- Insurance report focuses primarily on claim necessities.

- Assess which report you need based on your specific situation.

- Accessing these reports may involve different procedures.

- After receiving either report, review it thoroughly for accuracy.

| Report Type | Description |

|---|---|

| Police Report | Official documentation providing detailed accident information. |

| Insurance Report | Details pertinent only to claims processing. |

| Legal Weight | Police reports typically hold more evidentiary value in court. |

| Details Involved | Police reports include statements and conclusions from officers. |

| Claim Processing | Insurance reports focus on specific financial details for claims. |

Understanding the differences keeps you prepared for future engagements with insurance companies or legal entities. Police reports are invaluable for their legal standing, whereas insurance reports are tailored for expediting claims. After weighing both options, determine which report serves your immediate needs best.

- Police vs. Insurance reports hold different purposes.

- Choose wisely based on your particular situation.

- Be ready to navigate each report’s intricacies.

- Clarify what each report provides to your case.

- After clarity is achieved, proceed with the necessary actions.

The Role of Insurance Companies in Accident Reports

Insurance companies play a vital role in the aftermath of an accident, relying heavily on crash reports to assess liability and determine compensation. These reports provide an objective account of the incident, summarizing crucial details such as the location, time, and damages incurred. When you submit a claim, your insurer will analyze the report alongside other evidence, ensuring a comprehensive evaluation of your case. This process highlights the importance of accurate documentation, as any discrepancies can jeopardize your claim.

Best Practices for Communicating with Insurers

Effective communication with insurers can streamline the claims process and enhance your chances of a favorable outcome. Be clear and concise when discussing the crash details, and always provide complete, truthful information. Promptly respond to any inquiries and keep records of all communications, including dates and contact names. This level of organization not only demonstrates your diligence but also supports your position if disputes arise.

Common Pitfalls When Using Crash Reports for Claims

Relying solely on crash reports without additional documentation can lead to significant setbacks in your claims process. For instance, if the report contains inaccuracies or omits critical context, it may weaken your case, causing delays or denied claims. Furthermore, not cross-referencing the report with witness statements or photographs from the scene can leave gaps in your argument for liability and damages.

In many cases, individuals overlook the need to review crash reports thoroughly before submission. If you don’t identify errors or incomplete information, your insurer may regard the report as definitive, complicating your claim. Additionally, relying solely on the official report without gathering supplementary evidence like photos or eyewitness accounts can hinder your ability to present a robust case. Understanding that crash reports are pivotal but not exhaustive will enable you to build a more comprehensive claim, increasing your chances of receiving the compensation you deserve.

Leveraging Crash Reports for Legal Proceedings

In legal disputes stemming from accidents, crash reports become invaluable pieces of evidence that can help clarify circumstances and establish liability. These documents summarize the incident, providing vital details such as the location, weather conditions, and statements from drivers and witnesses. You can leverage this information not only to support your claims but also to strengthen your case in negotiations with insurance providers or during litigation. A well-documented crash report can make a significant difference in pursuing rightful compensation for damages or injuries incurred.

When to Involve Legal Representation

Involving a lawyer is advisable when accidents result in significant injuries or disputes over liability arise. If you find yourself navigating complex negotiations with insurance companies or facing potential court proceedings, having legal representation can ensure your rights are protected. An experienced attorney can help interpret your crash report and utilize it effectively to present your case while advocating for your best interests throughout the legal process.

Utilizing Reports as Evidence in Accidental Liability Cases

Crash reports serve as official documentation, which can substantiate your claims in accidental liability lawsuits. The objective details provided in these reports, such as diagrams of the accident scene, contribute to a clear understanding of what occurred and who is at fault. When presented effectively, excerpts from these reports can reinforce your position in court, supporting your arguments with objective evidence rather than anecdotal accounts.

The weight of a crash report can be particularly compelling. For instance, in one case, a plaintiff presented a crash report that detailed a driver’s disregard for traffic signals, which played a crucial role in establishing liability. This documentation made it easier to demonstrate negligence in court, ultimately leading to a favorable outcome. Utilizing crash reports as evidence not only strengthens your case but can also expedite the resolution process, saving you time and stress in a complex legal landscape.

Additional Resources for Madison County Residents

Accessing supportive resources can significantly ease the aftermath of a crash in Madison County. Local organizations and online platforms offer various services to help you navigate the recovery process, ensuring you have adequate information and support available at your fingertips.

Local Law Enforcement and Support Services

Your local law enforcement agencies, including the Madison County Sheriff’s Office, play a pivotal role in maintaining safety and providing support post-accident. They can assist you with urgent inquiries about your crash report or direct you to legal resources. Additionally, community support groups are available to help individuals cope with the emotional impacts of accidents.

Online Tools for Tracking and Following Up on Reports

Utilizing online tools can streamline the process of tracking and following up on your crash reports. Many agencies offer dedicated portals where you can check the status of your report, access incident details, and find contact information for follow-up inquiries.

By leveraging these online resources, you can easily stay informed about your case even from the comfort of your home. Websites often feature user-friendly interfaces, allowing you to input your accident details for quick access to the information you need. Some platforms may enable you to download your crash report directly, ensuring you have all necessary documentation for insurance claims or legal purposes. This not only saves you time but also empowers you to take proactive steps in managing the aftermath of a traffic incident.