Crash incidents can be stressful and overwhelming, but you’re not alone in navigating the aftermath. This guide is designed to walk you through the process of obtaining your crash report in New Hanover County, North Carolina. With detailed steps, you can ensure that you have all the necessary information at your fingertips, facilitating a smoother resolution to your claim. Understanding how to access your report will empower you to take the right actions moving forward.

Navigating the Initial Shock of an Accident

Experiencing an accident can leave you in a state of disbelief and anxiety. Amidst the chaos, it’s natural to feel overwhelmed. Acknowledging your feelings in the immediate aftermath is a step toward regaining control, allowing you to focus on next steps and ensure your safety.

Emotional Reactions and Immediate Steps

You may encounter a whirlwind of emotions, such as shock, anger, or sadness. These feelings can cloud your judgment, making it crucial to take deep breaths and assess the situation calmly. Check for injuries—yours and others’—and prioritize calling for medical assistance if needed.

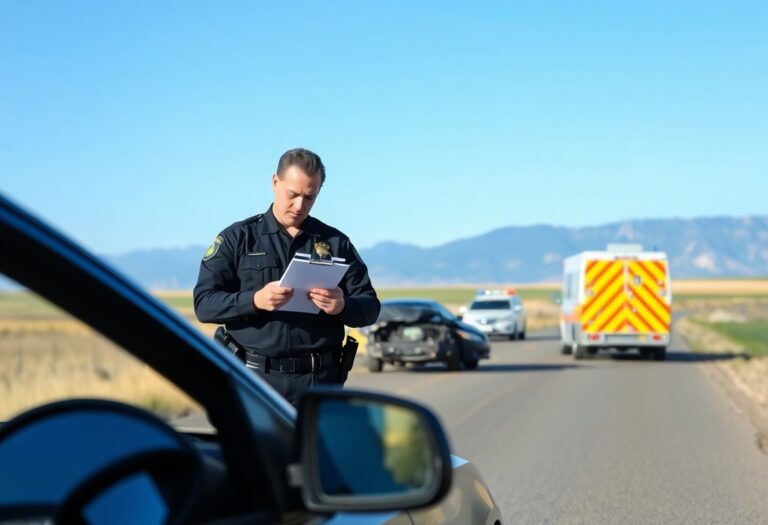

Maintaining Safety and Legal Obligations

Ensuring safety on the scene should be your primary concern. Turn on hazard lights, move to a safe area if possible, and help others relocate away from traffic. Notably, adhering to legal obligations is crucial. Collect information from all parties involved, including insurance details, and record the scene with photos to document the accident accurately.

While your emotional state may fluctuate, focusing on maintaining safety and fulfilling legal obligations can provide a sense of direction. As you assess the scene, gather names, contact information, and insurance details from everyone involved. Use your phone to capture images of vehicle damage, license plates, and road conditions. This documentation will be invaluable for your insurance claims and any legal proceedings that may arise, helping you navigate through the aftermath of the accident more confidently.

Demystifying Crash Reports: What You Need to Know

Understanding crash reports can feel overwhelming, but breaking them down into manageable sections simplifies the process. These documents outline the details of an accident, including information such as the vehicles involved, parties present, and the circumstances leading to the incident. By familiarizing yourself with the elements in a crash report, you can better interpret the findings and utilize them for insurance claims, legal proceedings, or personal records. Clarity in this process ultimately aids in making informed decisions moving forward.

Components of a Crash Report Explained

A crash report typically includes several key components: the date and time of the accident, the location, and a description of the vehicles involved. Additionally, you will find diagrams or illustrations of the scene, as well as witness statements. Your information, such as your driver’s license number and insurance details, also plays a vital role. Each element serves to create a comprehensive picture, so understanding each part can assist you in addressing any disputes or claims arising from the crash.

The Importance of Accurate Information

Accurate information in a crash report influences various aspects, from determining liability to expediting insurance claims. If any detail is misrepresented or omitted, it can lead to delays and complications in processing your claim. For instance, a misidentified fault can shift the financial burden onto the wrong party, complicating recovery processes significantly.

An example can illustrate this point. Consider a scenario where a report inaccurately lists the weather conditions or road signs at your accident’s location. If you rely on a flawed report, you may experience difficulties obtaining fair compensation because the insurance companies or legal entities assess situations based on the documented evidence. Taking the time to review your crash report thoroughly can save you from potential headaches and increase your chances of favorable outcomes in any follow-up actions.

How to Obtain Your Crash Report in New Hanover County

Accessing your crash report in New Hanover County is straightforward, provided you know the correct steps to take. You can obtain the report from the local police department or through the North Carolina DMV, depending on which agency was involved in your incident. Online portals are also available for convenience, enabling you to request your report without needing to visit in person.

Official Sources and Request Procedures

Your crash report can typically be obtained from the New Hanover County Sheriff’s Office or the Wilmington Police Department. You will need to provide specific details about the crash, such as the date, time, and involved parties. You can request the report online, by mail, or in-person, depending on your preference.

Understanding Fees and Processing Times

Obtaining a crash report often involves a fee that can vary by agency. Typically, the charge ranges around $5 to $15. Processing times may differ; while some reports can be accessed online instantly, others may take several days or even weeks to be processed, especially if they require further investigation or if additional documentation is necessary.

Being aware of the fees and processing times can save you headaches down the road. For instance, online report requests are usually the fastest method, allowing you to receive documents electronically, while mail requests may take longer due to the postal service. Additionally, keep in mind that if you are requesting a detailed or certified copy of your report, the fees could be higher, and processing times might increase accordingly. Planning ahead ensures you get your report in a timely manner that suits your needs.

Common Pitfalls When Filing a Crash Report

Knowing the common pitfalls in filing a crash report can save you time and stress. Many individuals overlook key details or misinterpret important instructions, which can lead to delays in processing. Failing to provide accurate contact information, not attaching necessary documentation, or neglecting to report injuries can hinder your ability to claim insurance. Attention to detail is crucial, as even minor mistakes such as incorrect accident dates can complicate your case or lead to outright denial of coverage.

Missteps That Could Delay Your Claim

Submitting your crash report with missing or incorrect information can significantly extend the claims process. For instance, if you fail to include a police report number or omit witness statements, the insurance adjuster may need to reach out for more information, causing lengthy delays. Furthermore, misunderstandings regarding medical documentation may impede your ability to access compensation for any injuries sustained.

Strategies for Avoiding Common Errors

To ensure your crash report is filed smoothly, adopt a few effective strategies. Begin by meticulously reviewing your report for accuracy before submission. Double-check names, addresses, and all applicable dates. Additionally, keep a checklist of required documents and details to prevent forgetting key information. Relying on clear communication with your insurance provider can further minimize the chance of misunderstandings and streamline your claims process.

Incorporating these strategies into your filing routine can lead to a more efficient process. Utilizing a comprehensive checklist can help you verify that all data is present and precise. It’s beneficial to engage in open dialogue with your insurance agent, asking clarifying questions if any sections are unclear. This proactive approach can reduce the likelihood of errors that typically result in claim delays, ensuring that you receive the compensation you deserve without unnecessary hold-ups.

Leveraging Your Crash Report for Insurance Claims

Your crash report is a powerful tool in navigating the complexities of insurance claims. It serves as an official document that can substantiate your version of events, detailing the circumstances and damages from your accident. By presenting clear, factual information, you can support your claim effectively and push for a favorable resolution with your insurance provider.

Turning Data into Action: What Insurers Look For

Insurance companies examine crash reports closely, scanning for details like the date, location, and parties involved in the accident. They also pay attention to diagrams, witness statements, and descriptions of damages that outline liability. Your report’s accuracy and clarity play a significant role in how insurers assess the situation and determine the rightful claims compensation.

Maximizing Your Compensation Potential

Maximizing your compensation potential hinges on how well you leverage the data in your crash report. The more thorough and precise your report, the stronger your case against the insurance company. Highlight specific injuries, property damage costs, and lost wages due to the accident, as these factors cumulatively establish your need for adequate compensation.

When addressing the potential for compensation, ensure every detail in your crash report aligns with your claims. Include photographic evidence, medical records, and any follow-up treatments to bolster your case. Ensure all damages are documented, from minor repairs to extensive medical treatments. By preparing a detailed narrative supported by factual evidence, you make it harder for insurers to dispute your claim, ultimately leading to a higher likelihood of receiving the compensation you deserve.

Summing up

Now that you have clear guidance on how to obtain your crash report in New Hanover County, North Carolina, you can navigate the process with confidence. By following the outlined steps, you’ll access vital information that can assist you in any necessary follow-up actions regarding your incident. Ensure all your documentation is in order and utilize the online resources or contact local authorities if you have questions. This methodical approach will help you secure your report efficiently.