Most drivers in Tama County know that accidents can happen at any moment, leaving you feeling overwhelmed and unsure of what to do next. Understanding how to obtain your crash report can significantly aid in navigating insurance claims and legal obligations. This informative guide will equip you with the crucial steps to access and utilize crash reports effectively, ensuring you’re prepared to handle these situations with confidence and ease. Whether you’re filing a claim or seeking compensation, having the right information at your fingertips will make all the difference.

Navigating the Aftermath of a Crash in Tama County

Finding your footing after a crash in Tama County can feel overwhelming, but knowing the right steps to take can help ease the burden. As you navigate the aftermath, focusing on the vitals can make the process smoother and support your recovery efforts. Assessing your situation and understanding what to expect next will empower you to take charge as you move forward.

Key Steps to Take Immediately After a Collision

Securing safety should be your first priority after a collision. If you can, move your vehicle to a safe location and check for injuries among everyone involved. Contact emergency services to report the accident and facilitate any needed medical attention. Once the scene is stabilized, exchange information with other parties and document the environment for future reference.

Essential Information to Gather at the Scene

Collecting vital information right at the scene of the accident helps build your case later on, whether it’s for insurance or legal purposes. Make sure to note the names, contact details, and insurance information of all parties involved, as well as the details of any witnesses. Take photographs of the damage, license plates, and overall scene, ensuring that you capture comprehensive evidence.

Gathering this vital information can play a significant role in the claims process. For instance, noting the weather conditions, road signs, and traffic signals can provide context that factors into who may be at fault. If any witnesses are willing, their statements can bolster your account of the incident. Accurate documentation serves as a protective measure and can mitigate potential disputes that arise later when detailing the events that took place during the accident.

Understanding Tama County’s Crash Report System

The crash report system in Tama County is designed to document and analyze motor vehicle incidents to enhance safety and legal accountability. After an accident, police officers typically file a report that includes details about the crash’s circumstances, participants, and any resulting injuries or damages. These reports serve as important records for insurance claims, legal proceedings, and statistical analysis of traffic patterns in the area.

What Information is Included in a Crash Report?

A crash report typically contains important details such as the date and time of the accident, a description of the vehicles involved, the names and contact information of drivers and witnesses, and any citations issued. Additionally, it may provide diagrams or sketches showing the positions of the vehicles and details of the accident scene. This comprehensive information aids in understanding the dynamics of the crash and assessing liability.

How to Access Your Crash Report

Accessing your crash report in Tama County can be done through several simple steps. You can request a copy by contacting the local police department or the county sheriff’s office. Many agencies also offer online portals where you can search for and obtain reports electronically. Just ensure you have the necessary information, such as the date of the accident and the report number, if available.

For online access, visit the relevant department’s official website to locate the crash report section. Often, you will find a link providing instant access to report queries. Keep in mind that there may be a minimal fee for obtaining a physical copy. If you’re having difficulty navigating the site or finding specific reports, don’t hesitate to reach out to the department for assistance—local representatives are usually more than willing to help you through the process.

The Role of Law Enforcement in Accident Reporting

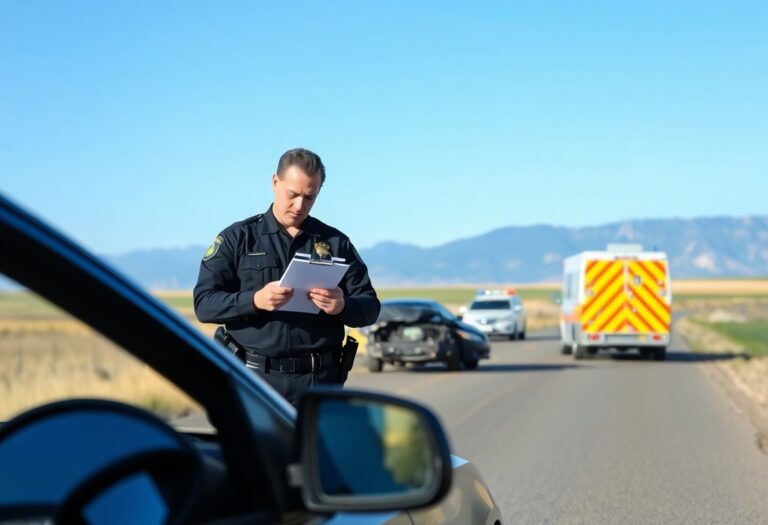

Law enforcement plays a vital role in the accident reporting process, ensuring that incidents are thoroughly documented and understood. Police officers arrive at the scene to assess the situation, gather evidence, and interview those involved. Their expertise helps establish an unbiased record of the event, detailing factors such as weather conditions, road hazards, and witness statements. This information is vital not only for regulatory purposes but also for the parties involved to secure accurate accident documentation.

How Local Authorities Document Accidents

Local authorities meticulously document accidents using a systematic approach involving the collection of physical evidence, photographs of the scene, and witness accounts. Officers often complete a standardized accident report that includes critical details, such as vehicle information, the names and addresses of involved parties, and any injuries sustained. This comprehensive documentation forms the foundation for resolving insurance claims and possible legal disputes.

The Importance of Police Reports in Legal Matters

Police reports hold significant weight in legal matters following an accident. These documents serve as official records that can either substantiate or dispute claims made by parties involved. In many cases, insurance companies rely on these reports to determine liability and evaluate claims effectively. Should the matter escalate to legal proceedings, police reports can provide critical evidence that influences court decisions, mediation, or negotiations. Accurate police reports aid in maintaining fairness and transparency, creating a clearer pathway for justice.

Having a thorough police report can greatly impact the outcome of legal battles after an accident. For instance, an absence of pertinent details in a police report could weaken your position during negotiations or court proceedings. If the report indicates that you were not at fault or presents evidence supporting your case, it can lead to quicker resolutions and fair compensation. These documents are often referred to as authoritative sources in court, so clear and comprehensive reporting is vital for both your legal protection and the upholding of public safety standards.

Seeking Legal Assistance: When to Call a Lawyer

Engaging with a lawyer can significantly influence the outcome of your accident claim. Knowing when to call in legal support is key, especially if the accident resulted in serious injuries, substantial vehicle damage, or disputes regarding liability. If you find yourself overwhelmed by medical bills, insurance communications, or aggressive tactics from the other party, enlisting a lawyer’s expertise could protect your rights and help you pursue fair compensation.

Recognizing the Signs That You Need Legal Support

You might need legal assistance if you experience persistent pain despite treatment, face permanent injuries, or if liability isn’t clearly established. The complexities associated with filing claims—particularly when negotiating with insurance companies—often signal the need for professional help. If the other party involved starts engaging legal counsel or if you feel pressured to settle quickly, it’s a strong indicator to consult a lawyer.

How a Lawyer Can Help You Navigate the Insurance Process

Navigating the insurance process can be both tedious and stressful, but a lawyer brings imperative skills and knowledge to manage these challenges effectively. They ensure that your claims are filed accurately and advocate for your best interests when dealing with insurance adjusters. By understanding the nuances of your policy and the state’s regulations, a lawyer can help maximize your potential compensation while minimizing your stress.

Lawyers are adept at scrutinizing the fine print of insurance policies, making sure you receive every cent owed to you. They can identify hidden benefits, calculate damages accurately, and negotiate settlements that reflect the true cost of your injuries and losses. Additionally, having legal representation can deter insurance companies from undervaluing your claim, as they know you are serious about pursuing fair compensation. It’s not merely about making a claim; it’s about ensuring that every aspect of your case is handled with professionalism and diligence.

Common Insurance Pitfalls to Avoid After a Crash

Insurance pitfalls can complicate your recovery process after a crash. Common mistakes include choosing not to file a claim at all, underreporting damages, or failing to understand the limits of your coverage. Each choice can significantly impact your ability to receive the compensation you deserve, leaving you to navigate the aftermath with less support than necessary. Understanding these pitfalls can help you establish a stronger foundation for your claim and ensure you utilize your insurance coverage effectively.

Understanding Your Coverage Options

Many drivers overlook the full range of their insurance coverage options. Simply relying on state minimums may not provide adequate protection in the event of a crash. You should review your policy to familiarize yourself with key coverage types like collision, comprehensive, and uninsured/underinsured motorist coverage. Each option plays a vital role in covering different aspects of accidents, offering financial security you might need when the unexpected happens.

The Consequences of Underreporting or Misreporting

Underreporting or misreporting your crash details can lead to complications that hinder your claims process. Accurate documentation is important for receiving proper compensation, as insurers rely on the information provided to assess your case. If you downplay injuries or damages, you risk facing challenges when trying to prove your losses later on, potentially resulting in a denied claim or insufficient payout.

Misreporting can also stem from mistakes made in the excitement or stress of the moment. For example, if you initially believe your injuries are minor but later develop complications, your insurer may question your credibility. A well-documented claim, including photographs of the scene and thorough medical records, is vital. Understand that even seemingly minor inaccuracies can open the door for insurance companies to dispute your credibility, ultimately impacting your financial recovery. Transformed documentation minimizes misunderstandings and maximizes your chances of fair compensation.

Summing up

Ultimately, when navigating the aftermath of a crash in Tama County, Iowa, having access to reliable crash report help is imperative for ensuring you understand your rights and options. With the right support, you can efficiently acquire your reports, assess any damages, and take the necessary steps for resolution. By staying informed and seeking assistance when needed, you can manage the complexities of the situation and work toward a positive outcome.