You have the right to seek reliable support when dealing with car accident reports in Phelps County, Missouri. Understanding the process can be overwhelming, especially if you’ve been involved in a serious incident. In this blog post, we’ll guide you through everything you need to know about obtaining your car accident report efficiently and accurately. With expert insights and trustworthy resources, you can navigate this challenging situation with confidence and peace of mind.

Essential Steps Following a Car Accident in Phelps County

Experiencing a car accident can be overwhelming, and knowing the right steps to take is vital for your safety and legal protection. Start by ensuring that you and others involved are safe, then proceed to gather important information and seek assistance as needed. These steps can significantly impact the handling of your case, so acting thoughtfully and efficiently is key.

Immediate Actions to Take at the Scene

After an accident, your first actions should focus on safety. Check for injuries among all parties involved, turn on your hazard lights, and move vehicles to a safe location if possible. Call 911 to report the incident, and exchange insurance and contact information with the other driver(s), while also documenting the scene with photos and notes.

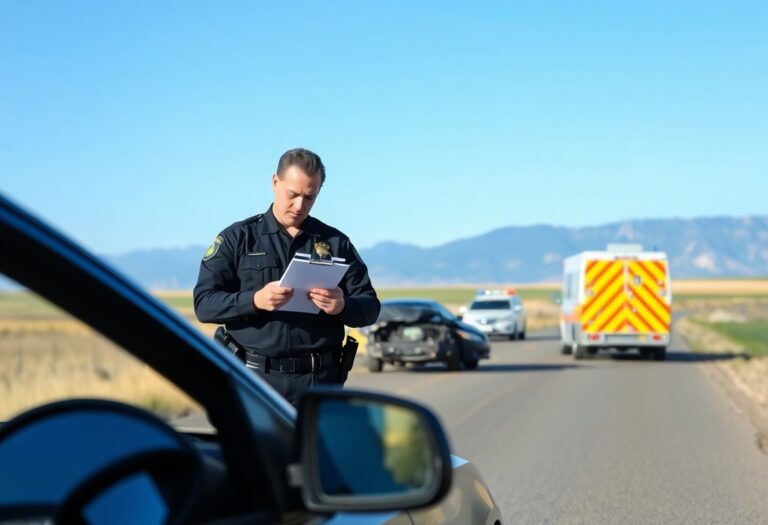

Navigating the Notification Process for Law Enforcement

Contacting law enforcement is a fundamental step following any significant car accident. In Phelps County, if there are injuries or significant property damage, the police will need to be involved to create an official report. This report can be pivotal in any subsequent claims or legal actions.

Upon calling the police, provide your name, location, and a brief description of the accident. This information helps officers prioritize the response. In Phelps County, local law enforcement may include the Missouri State Highway Patrol or county sheriff’s department. Once on scene, cooperate fully with officers as they gather information and insights. The official report generated by law enforcement can serve as an objective record of the incident, which is often required by insurance companies and can protect your interests as you navigate claims or potential legal matters.

Gathering and Documenting Evidence: Building Your Case

After a car accident, assembling and recording evidence serves as the foundation for your case. Collecting the right information equips you to navigate the insurance claim process and strengthen your position if legal action is necessary. By methodically documenting the accident scene, you enhance your ability to advocate for your rights and compensation.

Critical Information to Collect from the Accident Scene

At the accident scene, gather key details such as the names, addresses, and insurance information of other involved parties. Take note of the date, time, and location, and observe any traffic signs or signals nearby. It’s beneficial to document road conditions and weather at the time of the incident too. Make sure to capture the vehicle damages and any relevant skid marks or debris, as these can provide insights into the accident’s dynamics.

The Importance of Witness Statements and Photographic Evidence

Witness statements and photographic evidence play a pivotal role in substantiating your account of the accident. Witnesses can provide an unbiased perspective, detailing their observations of the events leading to the collision, which supports your narrative. Photographs capture crucial visual data, including vehicle positions, damage severity, and environmental factors, all of which help reconstruct the accident scene truthfully.

Having statements from witnesses can significantly bolster your claims, as they lend credibility to your story. When collecting these accounts, ensure that you gather names and contact information, allowing your legal representatives to follow up if necessary. Photographs should clearly illustrate the scene from multiple angles, providing a comprehensive view that can be invaluable in settling disputes or combating contradictory accounts from other drivers or insurers. A detailed collection of evidence ultimately empowers your case in negotiations and court, ensuring your truth is effectively communicated.

Understanding Legal Options: When to Consult a Professional

Understanding your legal options following a car accident in Phelps County is vital. Engaging a professional can provide clarity on the intricacies of the law and help you navigate the complexities of your case. You should consider consulting an attorney if you’ve sustained injuries, lost wages, or are facing challenges with insurance claims. A knowledgeable attorney can assess your situation, offer tailored advice, and advocate on your behalf, ensuring you pursue the rightful compensation for your damages.

The Role of Personal Injury Attorneys in Car Accident Cases

In car accident cases, personal injury attorneys serve as your trusted advocates, working diligently to protect your rights and maximize your compensation. They gather evidence, negotiate with insurance companies, and represent you in court, if necessary. Their expertise allows you to focus on recovery while they handle the legal complexities, increasing your chances of a favorable outcome.

Key Factors Influencing Compensation and Legal Outcomes

Various factors can influence your compensation and the overall legal outcome of your case. Essential elements include the extent of your injuries, the clarity of liability, and the strength of the presented evidence. Additionally, insurance policies, medical expenses, and lost wages play significant roles in determining the compensation amount you may receive. Understanding these factors helps set realistic expectations as you pursue your claims.

- Extent of injuries

- Clarity of liability

- Strength of the presented evidence

- Insurance policies

- Medical expenses

- Lost wages

Engagement in your case is key; the greater your knowledge, the better equipped you are to navigate the legal landscape. Compensation typically reflects the severity of injuries and the evidence supporting your claim. Factors like whether you were partially liable can also sway decisions, so being proactive and informed about your circumstances is vital. The more meticulously you document your experience, the stronger your case becomes, enhancing the likelihood of securing compensation.

- Extent of injuries

- Clarity of liability

- Evidence documentation

- Insurance coverage

- Statements from witnesses

- Recovery time

The Insurance Claims Process: Maximizing Your Settlement

Successfully navigating the insurance claims process can significantly impact your settlement amount. Begin by documenting all relevant details from the accident scene, including photographs, police reports, and witness statements. Keep a meticulous record of your medical treatments, property damage, and any expenses incurred as a result of the accident. Presenting this information clearly to your insurance provider will aid in maximizing the compensation you receive. Always stay persistent when communicating with the insurance company, and don’t hesitate to appeal if your claim is initially denied or you feel the settlement offered is inadequate.

Navigating the Intricacies of Car Insurance Policies

Understanding car insurance policies can be challenging, but knowledge is your best ally. Familiarize yourself with key policy terms like liability limits, deductibles, and the differences between collision and comprehensive coverage. Policies may vary widely in terms of coverage options and limits, so reviewing your own policy—or that of the other driver—can provide critical insights. This knowledge can also guide conversations with your insurer and ensure you’re leveraging every available resource in your claim.

Common Pitfalls to Avoid When Filing an Insurance Claim

Filing an insurance claim comes with potential pitfalls that can hinder your settlement. One major mistake is failing to report the accident promptly, which could lead to claim denial. Inadequate documentation is another frequent issue; without detailed records, it’s tougher to support your claim. Additionally, not fully understanding your policy can lead to missed benefits or underestimating your coverage. It’s also wise to avoid accepting the first settlement offer, as insurers often provide lower amounts initially, hoping to minimize their payouts.

Many individuals underestimate the significance of meticulous documentation. Not tracking your medical treatment and expenses or neglecting to gather evidence from the scene can leave your claim vulnerable. For instance, if you didn’t take photos of vehicle damages or get a copy of the police report, you may struggle to prove fault or the extent of your injuries and losses later on. Stay organized; create a file containing all pertinent information and correspondence related to your accident. This diligence can make a considerable difference in the outcome of your claim.

Long-Term Implications: Health, Finances, and Legal Responsibilities

Your car accident can lead to ongoing repercussions that last far beyond the initial crash. Medical treatments, rehabilitation, and even psychological therapy may become necessary, straining your health and finances. You might face lost wages due to extended recovery periods, all while managing potential legal responsibilities stemming from the accident. These factors can not only affect your immediate quality of life but also your long-term financial stability and mental well-being.

The Hidden Costs of Car Accidents Beyond Immediate Repairs

Car accidents often entail hidden costs that extend far beyond the repair bill. You may incur medical expenses for treatments and follow-ups, alongside costs related to ongoing therapies or medications. Additionally, vehicle depreciation may lower your car’s value, while the time missed from work can lead to significant financial strain. These elements highlight the importance of understanding all potential expenses following an accident.

Understanding Liability and How it Affects Future Coverage

Liability in a car accident determines who is financially responsible for damages and injuries. If you’re found at fault, your insurance rates may skyrocket. This can affect your ability to secure affordable coverage in the future, potentially necessitating higher premiums or reduced benefits. In fact, accidents can remain on your driving record for three to five years, impacting your rates and influencing the insurance companies’ view of your risk as a driver.

Insurance companies often weigh your driving history heavily when calculating premiums. For instance, a single at-fault accident can increase your rates by as much as 30% on average, although in some cases, it can be even higher. This persistent impact emphasizes the importance of being aware of liability rules and your legal obligations post-accident. Understanding how these factors influence your future can help you make informed decisions about your finances and insurance needs, ultimately safeguarding your financial future.

Final Words

With these considerations, you can navigate the complex process of obtaining a car accident report in Phelps County, Missouri, with confidence. Knowing the right steps to take and who to turn to can significantly ease your stress and ensure that you receive the support you need during this challenging time. By leveraging trusted resources and understanding your rights, you can effectively manage your situation and focus on your recovery. Don’t hesitate to seek assistance when needed, as reliable help is just a step away.